June 2025 Jobs Recap: Tariffs Continuing to Impact the U.S. Labor Market

LinkUp job data shows a continued decline amidst tariff activity in June.

Key Takeaways:

Hiring momentum slowed across the board, with active job listings down ~3% and new openings falling. Tariff escalation in June likely weighed on hiring decisions. This shift increased input costs for manufacturers and logistics firms, suppressing job postings in Manufacturing, Transportation & Warehousing, consistent with trade-sensitive hiring pullbacks.

Wage growth slowed modestly, with average hourly earnings rising just 0.2% in June, reducing the risk of overheating labor costs. Unemployment fell to 4.1%, due to fewer people in the labor force, not stronger hiring highlighting a "frozen" labor market in which jobs are added but not necessarily because more people are entering the workforce.

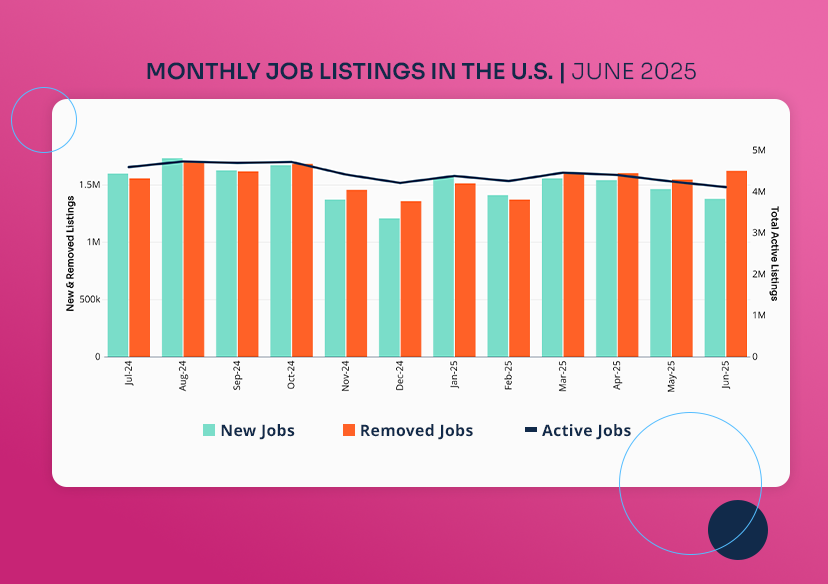

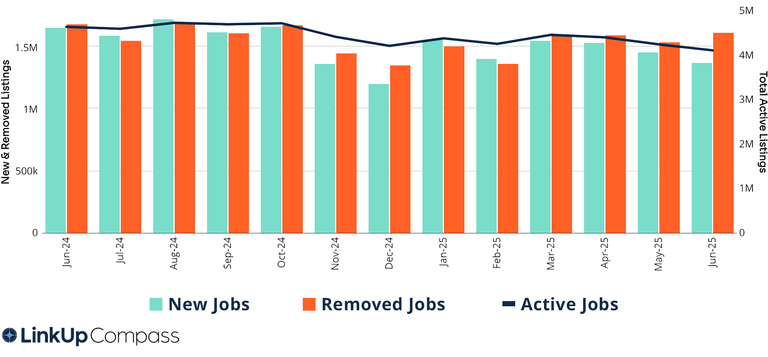

U.S. Job Listings by Month | June 2024 - June 2025

In June, active U.S. job listings declined 3%. New job openings created during the month dropped from 1.54 million to 1.37 million while removed job postings edged up from 1.54 million to 1.61 million.

LinkUp 10,000

The LinkUp 10,000 is an analytic published daily and monthly that captures the total U.S. job openings from the 10,000 global employers in LinkUp’s jobs dataset with the most U.S. openings.

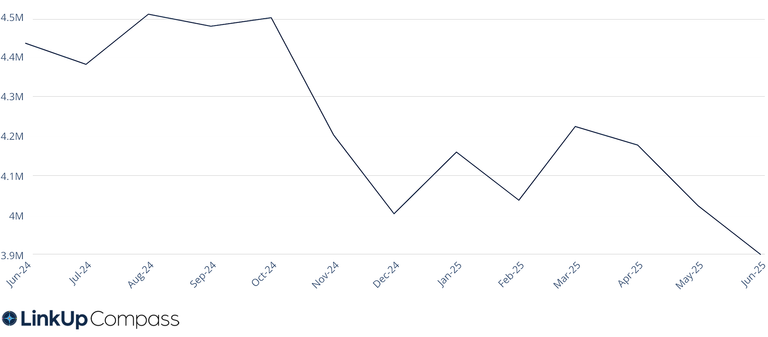

Monthly LinkUp 10,000 | June 2024 - June 2025

The LinkUp 10,000 index continued to decline slightly from 4.0 million in May to 3.9 million in June.

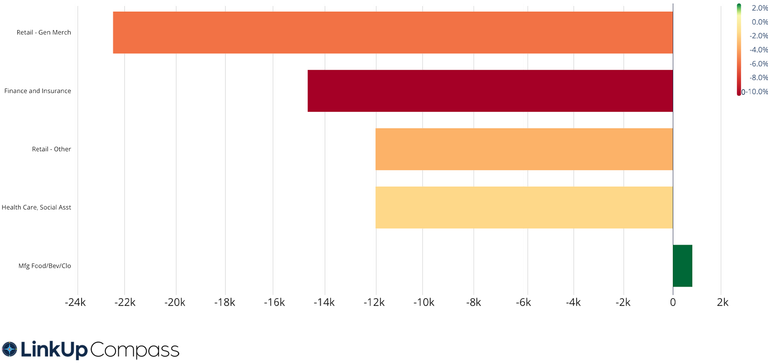

Jobs Data By Industry (NAICS)

We're seeing a decline in labor demand across most sectors for the month of June. The three largest by job openings count:

Retail General merchandise (-22k)

Finance and Insurance (-14k)

Health Care and Social Assistance (-12k)

In June, job openings declined across most industries, with only Manufacturing (specifically Food, Beverage & Clothing) showing month-over-month increases. Other Manufacturing Segments saw declines or flat openings due to persistent tariff uncertainty, which has hampered new orders and output in several sub-sectors.

Transportation & Warehousing job openings fell in line with broader trade slowdowns and has the highest YoY% drop in job listings. Retail Trade saw one of the steepest drops, as softening consumer sentiment weighed on discretionary spending.

Finance and Insurance also posted a significant drop, reflecting ongoing cost-cutting and hiring freezes across financial services firms.

Job Listings by Industry (NAICS) | June 2025

This chart displays the change in job listings across various industries, categorized by NAICS codes.

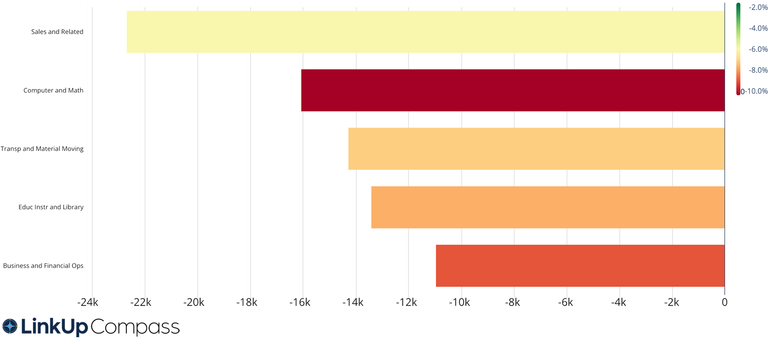

Jobs Data By Occupation (O*NET)

June saw job openings decline across nearly all occupational categories, continuing a broad-based hiring pullback seen over recent months.The largest declines observed in the following roles by job openings count:

Sales and Related (-22k)

Computer and Mathematical (-15k)

Transportation and Material Moving (-14k)

Sales and Related Occupations, where slower retail activity and weaker consumer demand translated directly into reduced demand for sales personnel particularly in non-essential goods and services.

Computer and Mathematical roles marked drop as tech companies and finance-adjacent firms paused hiring while Transportation and Material Moving Roles were impacted by tariff-driven declines in freight volume and trade-related activity.

Job Listings by Occupation (O*NET) | June 2025

This chart displays the change in job listings across various occupations, categorized by O*NET codes.

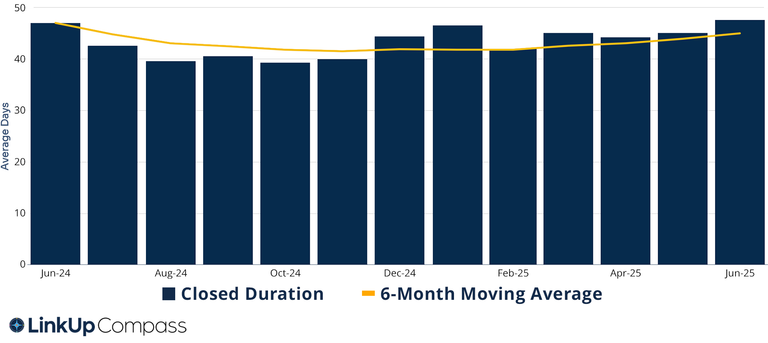

Closed Duration

Closed duration, or the average number of days job listings remain live on company websites before removal, tracks hiring velocity across the U.S. economy. As the average duration increases, hiring velocity slows.

Time to Fill By Month | June 2024 - June 2025

The closed duration increased to 47.7 days in June, up from 45.1 days in May. The rise in closed duration suggests that employers are taking longer to fill positions.

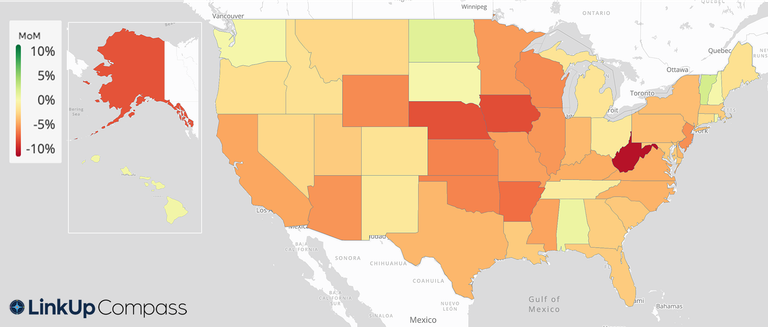

Jobs Data By State

During the month of June, 83% of the United States saw a drop in job listings from May. The states that saw the largest increases:

Vermont (+2.1%)

Washington D.C. (+1.8%)

North Dakota (+1.4%)

The states with largest drops in labor demand in June were:

West Virginia (-14.3%)

Iowa (-7.1%)

Nebraska (-7.0%)

Percent Change in Active Job Listings by State (Month-Over-Month) | June 2025

523 Companies Added

Every month, LinkUp indexes new companies to our database. In June, LinkUp added 523 additional employer websites.

Contact us if you are interested in obtaining the complete list of recently added companies.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

02.09.2026

January 2026 Jobs Recap: Modest uptick in job market observed in January 2026

Read full article -

Blog

02.04.2026

LinkUp Forecasting That the U.S. Economy Lost 25,000 Jobs in January

Read full article -

Blog

01.19.2026

The U.S. Economy, as a Job Creating Machine, Has Been Shut Off & Will Soon Be Hemorrhaging Jobs

Read full article

Subscribe to our Newsletter: Get monthly U.S. labor market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.