LinkUp's Job Data Points to a Balanced Job Market, Not a Weak One

LinkUp data shows gradually rising labor demand since January while JOLTS data points to a pretty steep decline.

We posted our most recent commentary on the job market on Sunday, followed by our nonfarm payrolls forecast for June (a net gain of 245,000 jobs) on Monday, but with the week’s JOLTS report and a few articles that have subsequently come out, there are a few additional points worth making before Friday’s jobs report.

On July 2nd, in an article entitled ‘US Labor Market Shows Signs of Losing Steam, Putting the Fed on Alert,’ Bloomberg noted that:

Economists and some Federal Reserve officials are increasingly on alert that pain could be on the horizon for American workers amid signs the labor market is losing steam.

Companies are posting fewer job openings this year and employees are quitting less as unemployment has begun creeping up from low levels, signaling the end of the historically-tight labor conditions that characterized the rapid recovery from the pandemic shock.

The article also cited the same Goldman research that we highlighted on our June 30th post detailing three soft spots in the job market (household survey weakness, May’s slight uptick in unemployment, declining quits) noted rising concern at the Fed:

Fed officials are still mostly sanguine about the state of the labor market, though they’ve begun to acknowledge rising risks.

“You’re really getting to that place relative to job openings and hiring” which “would mean higher unemployment as a result of further declines in job openings,” Fed Chair Jerome Powell said Tuesday at a European Central Bank conference. “You can’t know that with precision, but it’s very much understood by us that we have two-sided risks, and we have to manage them.”

The article ended with one last sign that the labor market was softening - the fact that “Employers have largely stopped offering the huge incentives they were providing to attract new hires in recent years.”

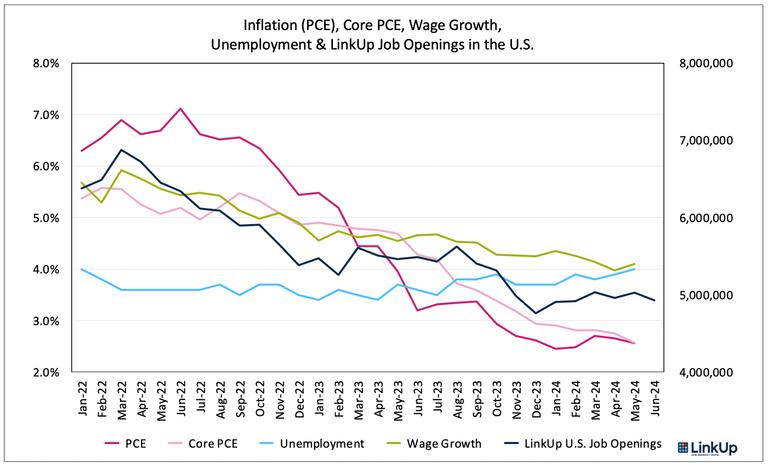

Without question, all of these things are true - job openings have dropped roughly 30% since March of 2022, quit rates have fallen markedly compared to a year ago, and the furious pace at which employers were raising wages and offering huge incentives to candidates has subsided significantly over the two past years.

It is also true, of course, that if labor demand continues to drop and the job market continues to soften, if layoffs increase and net job gains turn negative, a recession could materialize and things could spiral downward quite rapidly and unexpectedly. Those things are always true, and we are, most assuredly, at a critical juncture where visibility into the direction of the economy is exceptionally low and probabilities around a wide range of varied outcomes, both positive and negative, are quite evenly distributed.

But the markers of a softening job market increasingly cited by the media, Fed officials, and the commentariat - falling demand, subdued quits, rapidly declining wage inflation - are precisely the markers that denote a balanced job market with near-perfect equilibrium between labor demand and supply. And, in fact, that is precisely where the U.S. job market is these days, as we’ve noted for months.

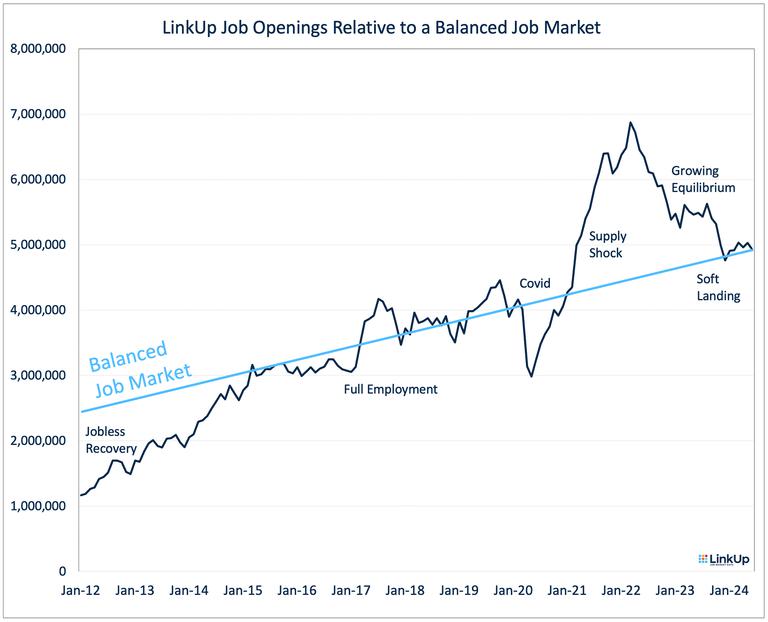

Looking at the recent history in the chart above, after aggressively raising wages and capitulating to every demand made by workers in order to bridge the yawning bid-ask spread between employees and employers (c. 2021-2022), employers were able to overcome the unprecedented, covid-induced supply shocks (workers, goods, and services) and labor supply-demand imbalance was slowly alleviated (c. 2022 and 2023).

Even as the Fed hiked rates aggressively to quell inflation (which they’ve done), employers added 7.3 million jobs during those two years (an average of 305,000 per month) and the job market powered the most successful post-covid economic recovery in the world - a gloriously soft landing by any measure.

With the addition of 7.3 million new jobs from 2022 to 2023, employers essentially filled all the post-covid ‘excess’ openings, the American workforce returned to work, everyone who felt compelled to do so switched jobs one or more times but eventually settled into their new jobs, employment participation returned to pre-covid levels, wage inflation settled down into a new normal around 4%, and balance was ultimately restored in the job market.

And that’s where we started 2024 - in a perfectly balanced job market with full employment. And as the chart at the top shows, the job market has maintained that near-perfect equilibrium all year as U.S. job openings have actually risen according to LinkUp job data (LinkUp tracks job openings directly from employer websites globally).

Between January and May, LinkUp job openings have climbed 5.6% from 4.76M to 5.03M. They dropped a bit in June but they’re still up 3.5% since the beginning of the year.

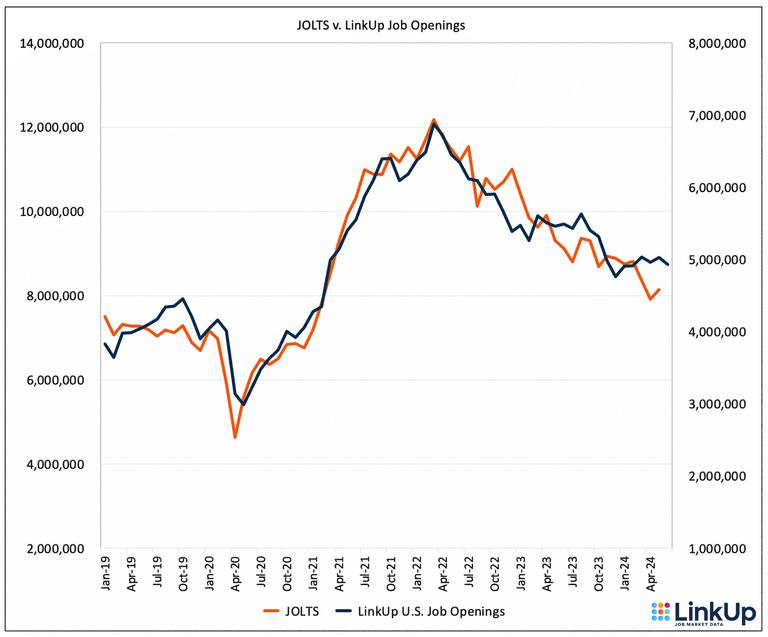

Our data stands in stark contrast with JOLTS data which indicates that job openings have dropped 8.4% since the beginning of the year. There are plenty of reasons to be skeptical of the ‘official’ government data that is based on surveys which fewer and fewer people are filling out, but leaving that aside, we’d point to actual job growth this year.

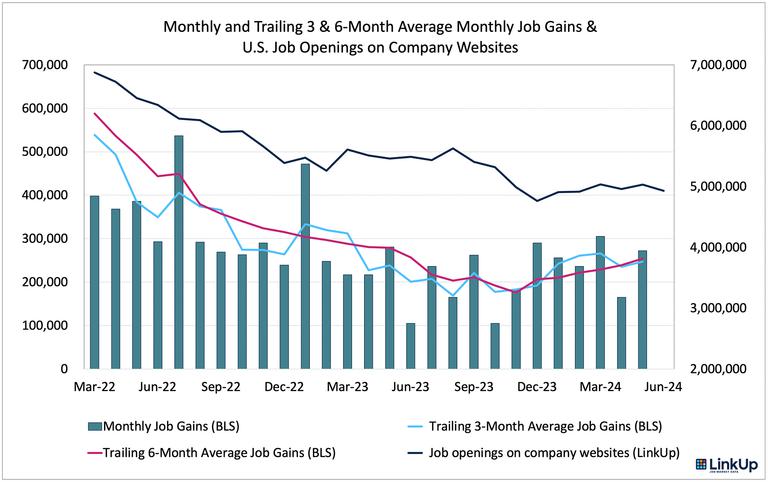

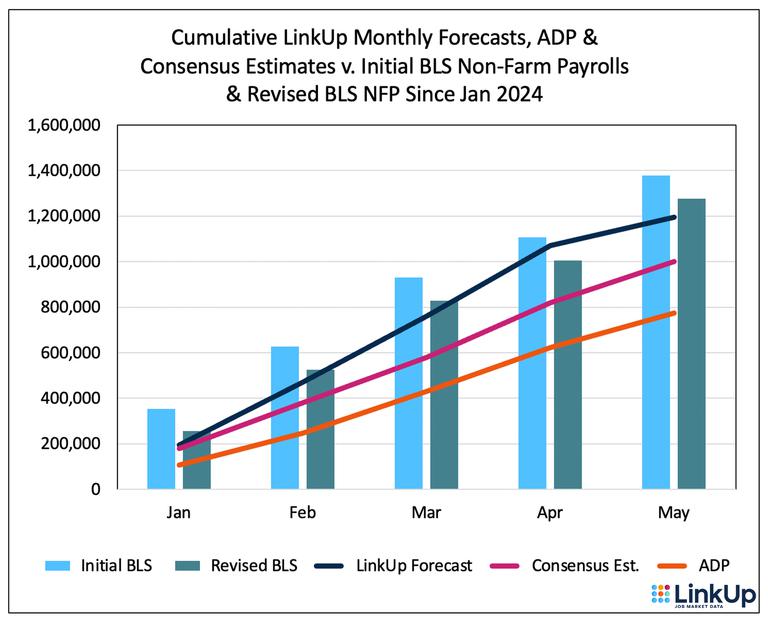

A surprise to most (but not all) observers, the U.S. economy has added a net gain of 1.28M jobs this year, an average of 240,000 per month - nearly the exact 245,000 jobs we’re forecasting for June.

So of course, things can and certainly will change at some point, and we’ll see what happens tomorrow with the initial jobs report for June, but as long as the job market remains in this perfectly balanced state, we expect to see continued solid job growth.

Happy 4th.

Insights: Related insights and resources

-

Blog

07.01.2024

LinkUp Forecasting a Net Gain of 245,000 Jobs in June as Labor Demand Drops a Bit in June

Read full article -

Blog

06.30.2024

A Balanced Job Market Continues to Chug Along, Powering the U.S. Economy

Read full article -

Blog

06.21.2024

SMCI Adds Scores of Jobs Quickly as AI Hardware Demand Soars

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.