November 2023 Jobs Recap: Job Growth Falls from Plateau to Decline

LinkUp’s job data for November 2023 completes a 90-day pattern of job growth decline. We’ve entered a new phase of the post-Fed hike era, and are likely to see labor demand decline across all states and sectors well into the first half of 2024.

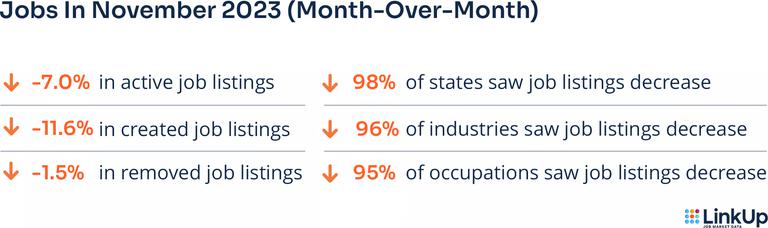

Key Takeaways:

Active Job Listings down 7% MoM and 12% since August, indicating a distinct downward trend in the previous 3 months. We expect the decline to continue in December.

Decreased Hiring Velocity indicates caution and choosiness among employers across sectors. Labor demand definitively tapering off.

Every major industry but one experienced decline in job listings; the dropoff in labor is systemic across the economy.

LinkUp forecasts a monthly NFP add of 50K jobs in November, well below the consensus estimate of 170K.

Mixed signals continue to cloud the macro outlook as the labor market cools off but GDP growth surprises to the upside, core inflation keeps falling, and jobless claims remain flat.

LinkUp job data for November indicates we’ve entered a new phase of the post Fed-hike economy: labor demand is definitively down after three months of decline.

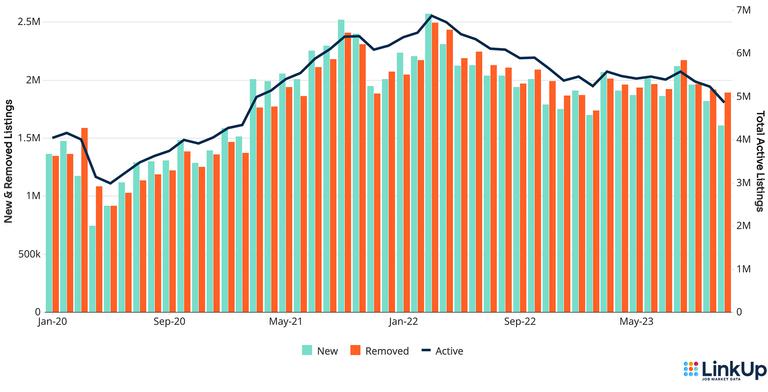

After the Fed initially raised interest rates in March 2022 to put the squeeze on inflation, the unprecedented pent-up labor demand post-COVID began to cool. But not much: during the nine months between March ’22 and January ’23, demand tapered surprisingly slowly and leveled off to a robust plateau by Q1 of this year. Unemployment held low and steady, wages stayed high while wage inflation dropped, and a stunning equilibrium of the labor market leveled us into a soft landing, in spite of the widely negative feeling of consumers grappling with inflation on the ground.

Now, as we evaluate a third consecutive month of decline in labor demand, that soft landing is looking pretty rough around the edges. At the end of November, the NYT podcast “The Daily” recorded an episode titled "The Bad Vibes Around a Good Economy." While many indicators continue to signal economic strength–Q3 GDP was revised to an impressive 5.2%; core inflation dropped to 3% in October; and joblessness claims remained flat–a continued slackening of labor demand through the end of the year would bring the prospect of recession closer. In other words, the numbers may start to match the “vibes.”

At LinkUp, we’re approaching the data with a cautious concern. We are projecting an NFP job add of 50K for November, considerably below the consensus estimate of 170K. We expect December may clock in with the first negative job report in 35 months. And yet, by many measures the American economy is doing better than it has in years.

As always, we’ll continue to provide timely, actionable, and accurate job data to help you interpret the ever shifting ground of the labor market and the economy at large. See a granular breakdown of November’s job data below.

U.S. Job Listings by Month | Jan 2020 - November 2023

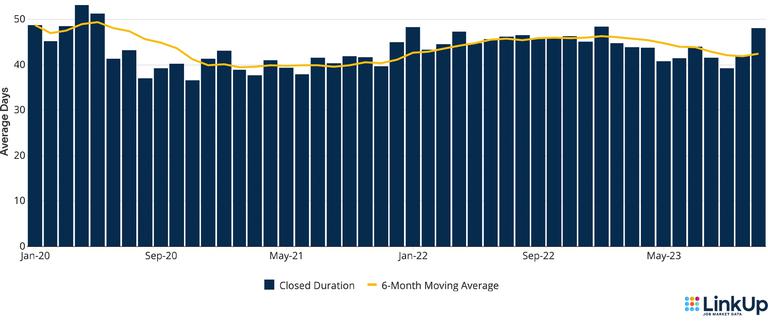

CLOSED DURATION

The entire U.S. economy tracks hiring velocity by measuring closed duration, or the average number of days that companies post job listings on their websites before removing them. As the average number of days a job listing remains live increases, hiring velocity slows.

The average number of days a listing remained on employer websites was 48.0 days. Compared to last month, hiring velocity has continued to slow down for the second consecutive month. The month over month increase in closed duration was influenced by a significant increase across the majority of industries.

Closed Duration of U.S. Jobs | Jan 2020 - November 2023

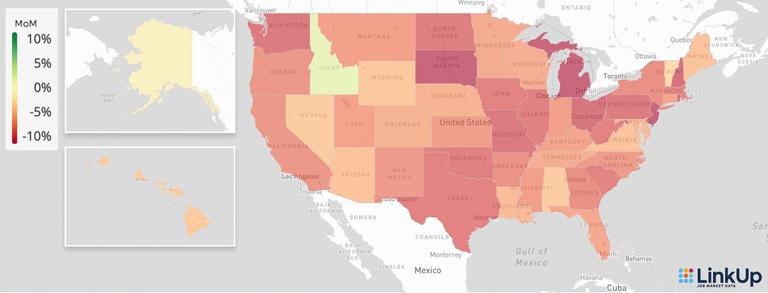

JOBS DATA BY STATE

With the exception of one state, all other U.S. states and Puerto Rico, had a decline in job listings. Idaho was the only state experiencing an uptick with a modest increase of 1.7%. The five states with the largest decline in job listings included:

Puerto Rico (-11.5%)

South Dakota (-10.1%)

Michigan (-10.1%)

New Jersey (-10.1%)

New Hampshire (-9.3%)

Percent Change in Active Job Listings (Month-Over-Month) | November 2023

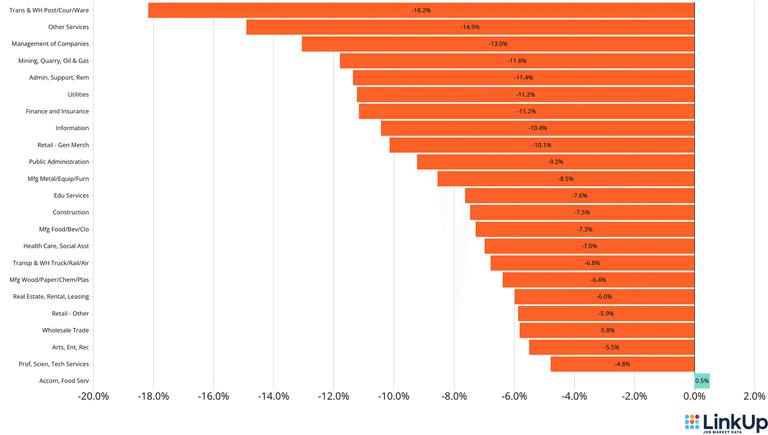

JOBS DATA BY INDUSTRY (NAICS)

96% of industries showed a decline in job listings compared to last month. The Accommodations and Food Services was the only industry that experienced growth (+0.5%). As for the top 5 industries that dropped in demand were:

Transportation & Warehousing (Postal/Couriers/Warehousing) (-18.2%)

Other Services (except Public Administration) (-14.9%)

Management of Companies (-13%)

Mining, Quarry, Oil & Gas Extraction (-11.8%)

Administrative, Support, Remediation Services (-11.4%)

Job Listings by Industry (NAICS) | November 2023

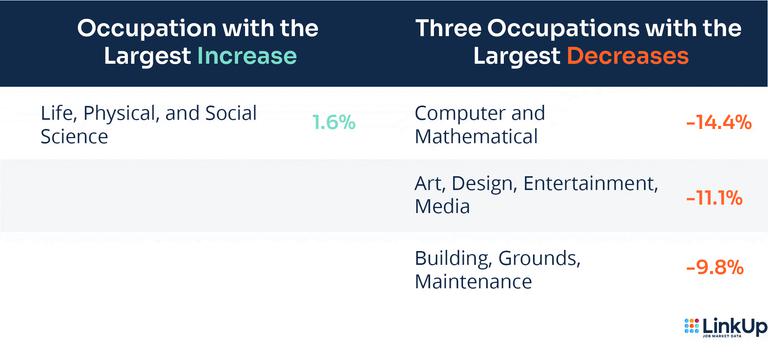

JOBS DATA BY OCCUPATION (O*NET)

In November 2023, only the occupation of Life, Physical, Social Science experienced growth (+1.6%). The occupations with the largest decline were:

Computer and Mathematical (-14.4%)

Arts, Design, Entertainment, Sports, and Media (-11.1%)

Building and Grounds Cleaning and Maintenance (-9.8%)

LINKUP 10,000

The LinkUp 10,000 is a daily and monthly analysis that shows the number of job openings from 10,000 global employers with the most U.S. job openings in LinkUp’s dataset.

The LinkUp 10,000 steadily continues to decline. For the last 12 months job listings from the top 10,000 global employers have declined by 14%, while last month it declined by 7%.

Monthly LinkUp 10,000

If you’d like more granular economic data or would like to look deeper into specific industries, occupations or companies, trial our job data or request a sample.

COMPANIES ADDED

LinkUp collected job listings on 612 new employer websites during the month of November 2023. Every month we index new companies to our LinkUp job listing database and have been steadily increasing with the current 6 month moving average.

Contact us if you are interested in obtaining the complete list of recently added companies.

LINKUP MONTHLY FORECASTS

Stay tuned for our monthly forecast of the BLS JOLTS report which drops next Wednesday, ahead of the release of JOLTS data from the Bureau of Labor Statistics (BLS). The data includes estimates of the number and rate of job openings, hires, and separations for total jobs from private employers, by industry and by establishment size class.

Also, each month we publish a nonfarm payroll report forecast ahead of the BLS release, which is based on our RAW LinkUp job listing data. The NFP report is based on total U.S. job vacancies and provides insight into anticipated growth or decline in job listings.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

11.06.2023

October 2023 Jobs Recap: Labor Market Analysis

Read full article -

Blog

11.01.2023

The Soft Landing Happened. Game Over. America Won. And October NFP Will Be 210,000.

Read full article -

Blog

11.01.2023

October 2023 Citi Report: LinkUp Job Data and the Future of Work

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.