June 2023 NFP Forecast: Strong Net Gain of 310,000 Jobs in June Will Further Confound the Pundits and Commentariat

The U.S. job market is now entering a 3rd phase of the pandemic era - a phase that will be entirely determined by what the Fed does going forward

Last week, the Commerce Department revised Q1 GDP growth from 1.1% to 2% and like clockwork, the pundits and the media issued their updated communications and news stories replete with newfound optimism and a barrage of quotes stating the obvious about what they can now so clearly see in their rearview mirror.

In a NYT story on the 29th, Ben Casselman provides a blurb from a client note sent by the chief economist at a large accounting firm after the GDP release:

The new data is cause for “genuine optimism,” wrote [the chief economist] in a note to clients. “This is leading many to rightly question whether the long-forecast recession is truly inevitable.”

I’ll admit that I am not aware of the economist’s prior views regarding the likelihood of a recession in ‘22/’23, but the quote is perfectly emblematic of how economists, forecasters, Wall Street, and the commentariat, the majority of whom shaped the consensus view over the past year that a recession was imminent, have reacted to the steady stream of positive news over the past 9 months.

That consensus view around the Most-Anticipated-Recession-Ever (always a mirage to begin with) is finally, at long last, beginning to be crowded out by acknowledgement that we might actually have witnessed (or, for some, are witnessing) a soft landing.

Inflation has dropped from 9% to 4%, the economy has grown steadily, optimistic consumers are still spending money, the housing market is solid, and unemployment has remained at or near historic lows.

And yet there remains a pocket of stubborn cranks and chronic pessimists who cannot bring themselves to admit what’s happening. Either that or the persistently confounded simply have no idea what’s happening.

In a WSJ article (U.S. Economy Shows Surprising Vigor in First Half of 2023), a chief economist at a large wealth management firm admitted that, “We have systematically underestimated the resilience of the American economy.”

What a perfect euphemism for ‘We have no idea what is happening and our ignorance is structural in nature.’ And by the way, who is the ‘we’ being referred to - their team of economists and researchers? I hope that’s the case rather than presuming to speak for all people weighing in on what is happening in the economy.

In another WSJ article (America’s Hot Labor Market Fuels Job Growth in Unexpected Places), Daniel Zhao, the lead economist at Glassdoor, an employer review site and a subsidiary of Indeed, states, “The labor market has continually surprised.”

Surprised who? You, perhaps, but certainly not everyone.

In fact, since 2009 when we first started using our LinkUp job data indexed directly from company websites around the world to forecast nonfarm payrolls, we also provided a running commentary on what we were seeing in the job market, what we believed were the driving factors behind those observations, what it meant for the U.S. economy, and what we thought was likely to happen in the future (short, medium, and long-term).

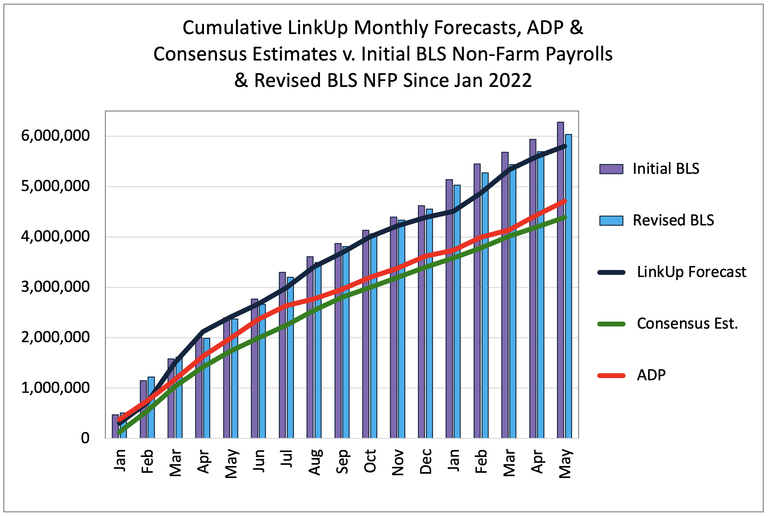

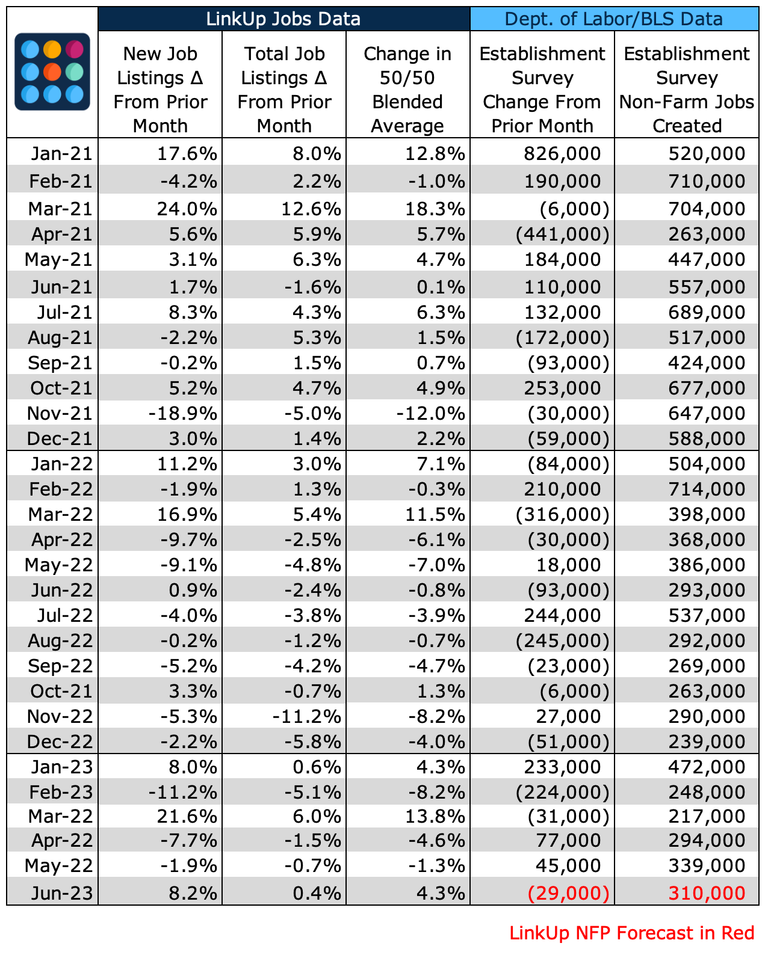

Leaving aside our own assessment of our commentary, our NFP forecast model has held up extraordinarily well, even in the present pandemic era. Since January of 2022, our forecast has been off from BLS data by 3.8% as compared to 27.2% for consensus estimates and 21.9% for ADP.

As to the commentary, I’d summarize (in wildly over-simplified fashion) our observations since the pandemic cataclysm, divided into into two distinct phases, as follows (and please feel free to read past posts if you doubt the validity of the summary):

Phase 1 - Supply Shock - March 2020 - February 2022

The pandemic and resulting quarantine dealt a massive supply shock to the economy by obliterating the supply of workers who couldn’t perform their roles remotely which quickly resulted in the decimation of the supply of both goods and services. Massive, seemingly insatiable demand for goods with no supply resulted in significant inflation which was exacerbated by the war in Ukraine and aggressive but appropriate fiscal and monetary policy.

As vaccines began rolling out, people very slowly began returning to work but with a vastly and fundamentally (and we’d argue permanently) altered perspective on life in general and work in particular, thus beginning the ‘Great Resignation’ and a protracted dearth of workers willing to return to their old jobs, their old employers, their old salaries, or the old, pre-pandemic world where the balance between employers and employees was massively skewed in favor employers.

So as the economy slowly opened up in fits and starts, demand for goods remained strong while demand for services skyrocketed, and the ‘bid-ask’ spread between employers and employees reached unprecedented levels.

Companies reacted to this bid-ask spread very quickly by raising wages, acquiescing to remote work, ceding to every single demand put forward by employees and job candidates, and generally accommodating anything and everything needed to get people back to work to meet the overwhelming demand of U.S. consumers.

Of course this happened in fits and starts and played out over a year or so, but the end result was a combination of rising wages, rising inflation, rising employment and labor force participation, rising corporate profits, and the fastest recovery in the world.

Phase 2 - Fed Achieves a Soft Landing - March 2022 - June 2023

To tame inflation and cool down the economy, the Fed began aggressively hiking rates in March of 2022 and while those hikes began to gradually ripple through the economy, employers continued to hire aggressively to get employment levels where they needed to be to meet insatiable demand.

That aggressive hiring, combined with a slowly cooling economy and ebbing labor demand (as rate hikes took effect but also as things returned to ‘normal’ everywhere) and isolated but high-profile layoffs (mostly by large-cap tech but also by companies with weak business models), resulted in greater and greater equilibrium between supply and demand in the labor market and declining need to keep raising wages to fill openings (except in very specific parts of the economy).

In the 15 months since the Fed began hiking rates, inflation has dropped from 9% to 4%, the economy has added 4.5 million jobs, GDP growth has averaged 1.6% per quarter, and unemployment has remained at historic lows.

There is no way to label what has happened over the past 12 months as anything other than a soft landing, an outcome that virtually no one regarded as possible a year ago.

But even with all the evidence, there remains a cohort of pessimists and cranks that cling to the belief that a recession is imminent.

As Bloomberg noted recently (Why a US Recession Might Happen in Time for 2024 Election):

The US economy has proven resilient after more than a year’s worth of interest-rate hikes, with a steady drumbeat of recession predictions having been proven wrong. New data released this week continued to point away from a downturn. Still, some forecasters warn a recession might still be coming, and that it could coincide with the 2024 presidential election.

And from another economist who still sees recession storm clouds on the horizon, perpetually off in the distance, “The economy still is quite healthy and seems to have some momentum remaining. Our forecast is still for the economy to slip into a mild recession, but we think that’s going to come later than we previously thought.”

Equally as prevalent as the pessimists, cranks, Recession Truthers, and those who make exceedingly non-specific, irrelevant forecasts like the one above, are those who cannot make heads or tails of what’s going on in the job market (often citing ‘mixed signals’ or ‘conflicting data’) or mischaracterize a positive data point as negative, an ‘ominous’ sign of what’s to come.

This was particularly the case following last month’s jobs report when job growth came in higher than most people expected but unemployment rose a bit and hours work dropped.

On those two points and my own third, I’d offer the following:

- Unemployment can rise when more people move from the sidelines into the job market because they are compelled to seek a job because they need one or because the offer or ‘bid’ employers are making is sufficiently attractive

- As companies are now finally filling job openings that have been open for a long time, it’s only natural that they would reduce hours for their workers who have had to work far longer hours than normal through overtime and double shifts when labor was in such short supply and demand was extraordinarily high

- Wage inflation is tapering off in most areas of the economy because employers have already raised wages such that they have been able to fill the openings and no longer need to keep raising wages. Having said that, wages are still rising in certain sectors of the economies such as food service, leisure and hospitality, and other low-wage portions of the economy. Because these also happen to be among the largest sectors of the U.S. economy, even small wage gains there can have an outsized impact on overall wages across the economy - so volatility in wage inflation numbers might persist.

So with all of that, we can not pick up with Phase 3 and where we are today.

Phase 3 - What Will the Fed Do? - July 2023 - ??????

As we’ve noted in previous posts, we’d argue that the U.S. economy could hardly be in a more perfect place and that the Fed, having achieved the much sought-after soft landing, should do nothing except raise its long-term inflation target to a 3-4% range. Barring that (and given the low probability of that happening), we’d argue that at a minimum, the Fed should pause for at least few months to let its hiking regimen take full effect.

Not surprisingly, however, the Fed chair has signaled that at least two more rate hikes are likely in the months ahead, even as members of the FOMC voice uncertainty about what the Fed should do or advise that the Fed, at a minimum, hold tight for the time being.

And unfortunately, what happens with the economy in general and the labor market in particular is entirely dependent on what the Fed does going forward as far as rates are concerned. And given that we are not in the business of forecasting Fed policy at any point in time, but especially this most uncertain of moments, we’ll stick to forecasting non-farm payrolls for June.

And on that front, we suspect that if June’s payrolls come in as we expect (net gain of 310,000) we’ll see more shock and confoundment among the vast majority of economists, pundits, and commentariat.

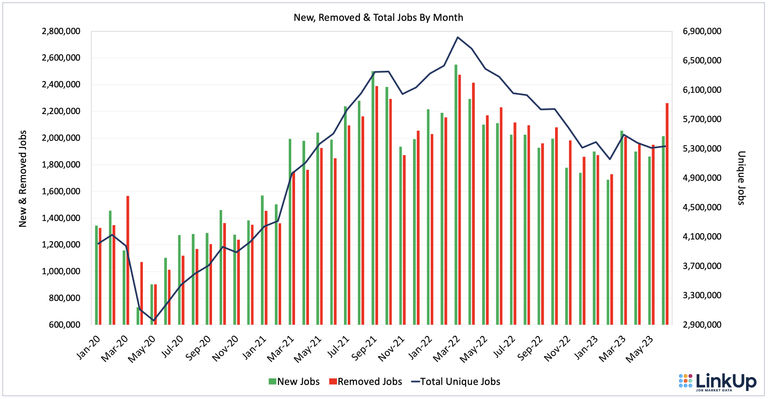

Looking at our job market data for June, total job openings in the U.S. rose 0.4%, new openings rose 8.2%, and job openings removed from company websites jumped 16.0%.

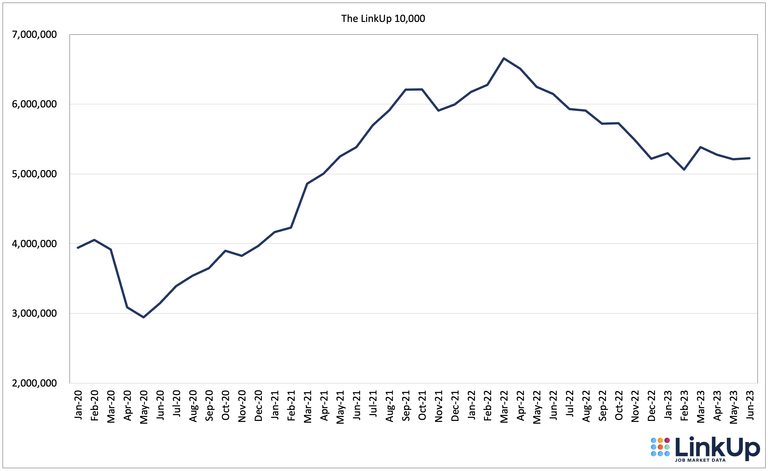

The LinkUp 10,000, which tracks U.S. job openings for the 10,000 global companies with the most openings in the U.S., rose 0.3%.

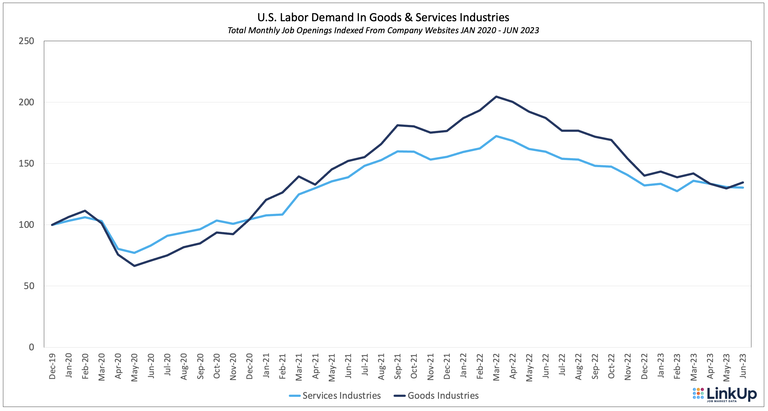

Job openings in manufacturing rose about 4% and total job openings in services dropped by just under .4%

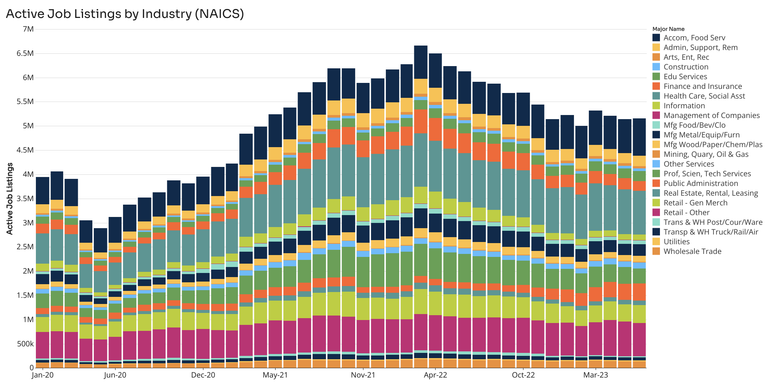

By industry, openings rose the most in Transportation (Courier/Warehousing), Accommodation-Food Service, and Manufacturing (Wood/Paper/Chem/Plastic), and dropped the most in Professional Services, Finance, and Transportation (Truck/Rail/Air).

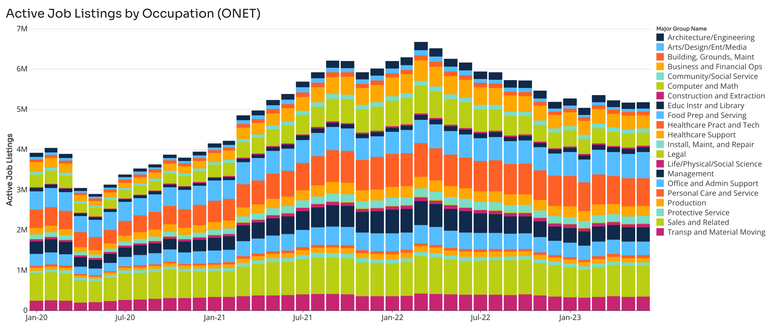

By occupation, openings rose the most in Food Prep and Maintenance & Repair, and dropped the most in Business & Finance, Computer & Mathematics, and Healthcare Support.

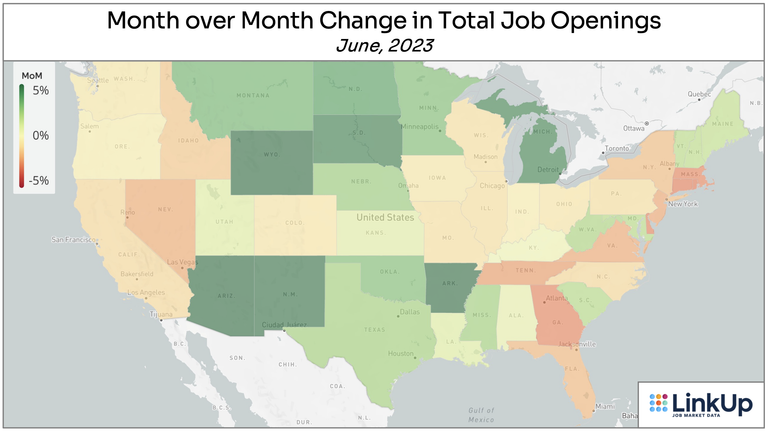

Across the country, total openings rose the most in the central U.S.

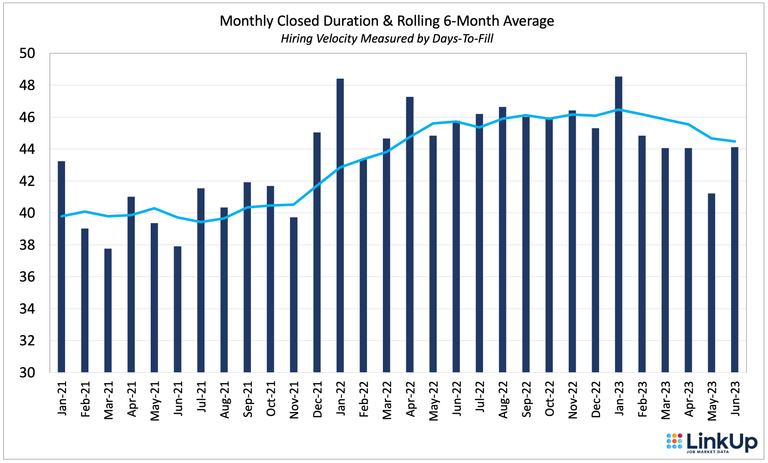

Across the entire economy, it took an average of 44 days for employers to fill openings in June - up from 41 days in May but just under the long-term historical average ‘time-to-fill.

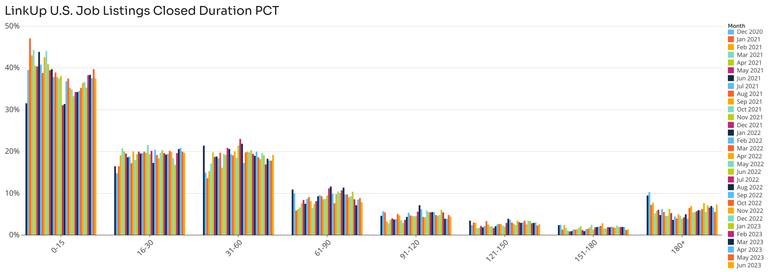

As we wrote in a piece a month or so ago about the myth of so-called ‘ghost’ jobs, we also break down our duration data by various duration ranges to track what’s driving duration as a whole.

So based on job openings data for May and June, we are forecasting a net gain of 310,000 jobs in June, a drop from May but well above the 225,000 consensus estimates.

We look forward to the post-Friday commentary as the usual pundits state the obvious while contorting their newly modified views to match the facts after June’s data has been released.

Insights: Related insights and resources

-

Blog

06.01.2023

LinkUp Forecasting Net Gain of 210,000 Jobs in May; Greater Job Market Equilibrium Furthers The Soft Landing

Read full article -

Blog

05.02.2023

LinkUp Forecasting Net Gain of 260,000 Jobs in April as Job Market Remains Resilient

Read full article -

Blog

04.09.2023

The Absurd Myth of 'Ghost Jobs'

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.