This Week in Jobs Data: The Great Starter Job Dieout

We're documenting the Great Starter Job Dieout as AI reshapes the workforce. OpenAI and Anthropic staff up for enterprise domination, Liberation Day's hiring stalls across major American manufacturers, and Oracle's cloud pivot triggers a dramatic resource reshuffling. Also, Novo Nordisk month-long layoffs signal.

Top Story: The Career Ladder Loses a Rung

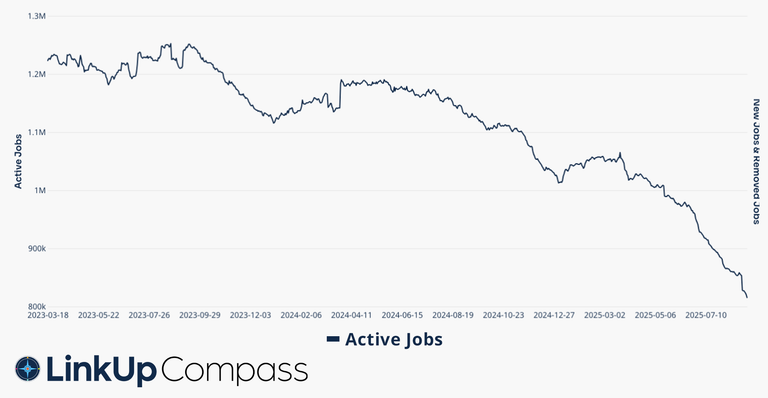

Traditional entry-level career pathways are disappearing, and LinkUp data captures the fundamental shift in real time. Entry-level hiring across all sectors, but particularly tech, has declined significantly as companies abandon junior talent development for AI automation and battle-tested hires.

The Compass charts below reveal the scope: active listings for entry level jobs declined across the U.S. job market as a whole from a 2.65 million peak in early 2022 to 1.9 million by September 2025—a 28% reduction accelerated by ChatGPT's late 2022 launch. Industry data confirms Big Tech companies reduced new graduate hiring by 25% in 2024 compared to 2023, while startup recruitment of recent grads fell 11%.

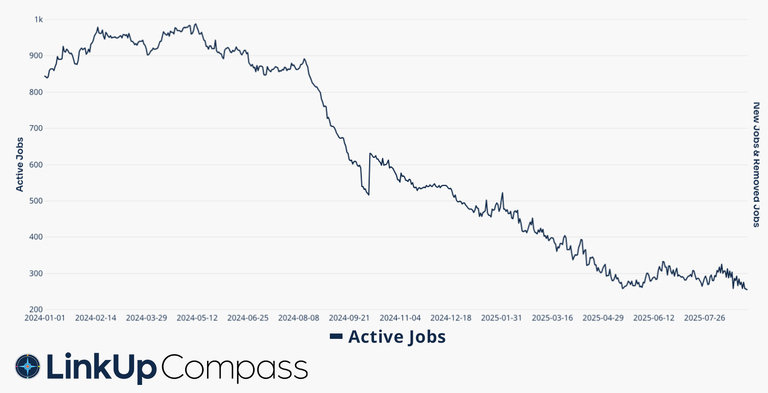

LinkUp data tracks a collective 75% decline at Microsoft, Apple, Meta, and Google from ~950 total active, entry-level listings in January 2024 to fewer than 250 by July 2025. This represents a systematic reduction in typical career entry points.

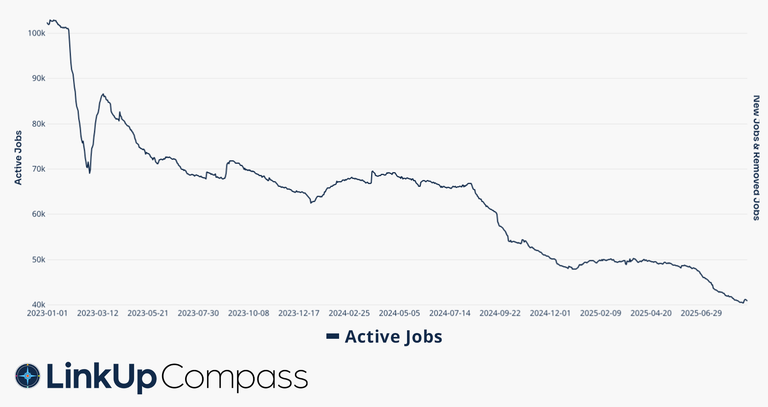

Entry-level roles classified under the Information/Tech industry code across the job market declined from over 100,000 listings to around 40,000 over the same period—a 60% reduction.

The average age of technical hires has increased by three years since 2021 as companies prioritize immediate productivity over long-term talent development. AI can complete many entry-level tasks faster than junior employees, with iteration cycles measured in minutes rather than days.

Starter Job Die-Off. Entry-Level Listings fall 34% Across U.S. Job Market since 2022

Collective Entry-Level Listings down 75% at Microsoft, Apple, Google, Meta since 2024

Daily Entry-Level Listings in Tech down 60% from 100K to 40K since 2023

AI Sales Teams Scale for Enterprise Arms Race

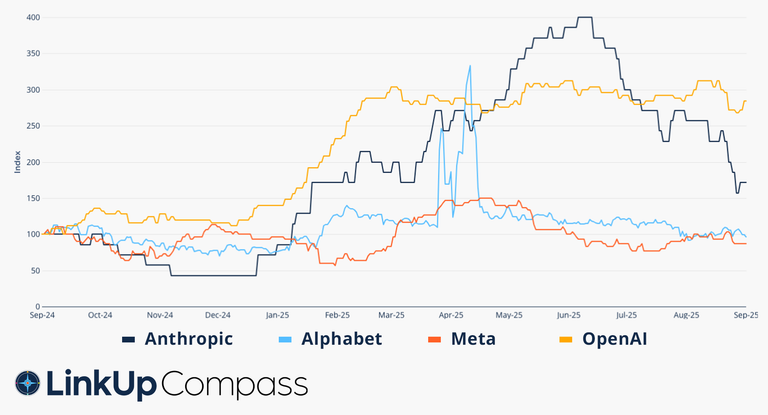

While AI models work overtime to eliminate entry-level positions, the companies building these systems are aggressively expanding commercial operations. LinkUp data shows both OpenAI and Anthropic boosting sales hiring as the AI market pivots from research novelty to enterprise necessity.

The enterprise focus reflects market maturation. While most of OpenAI's $4 billion in 2024 revenue came from consumer sales, the company is making enterprise inroads with customers including Moderna and Lowe's. Microsoft's recent decision to use Anthropic's Claude Sonnet 4 alongside OpenAI's models in Office 365 applications validates their enterprise strategy.

Company Compare. Hiring up YoY at OpenAi and Anthropic; stalled at Meta, Google

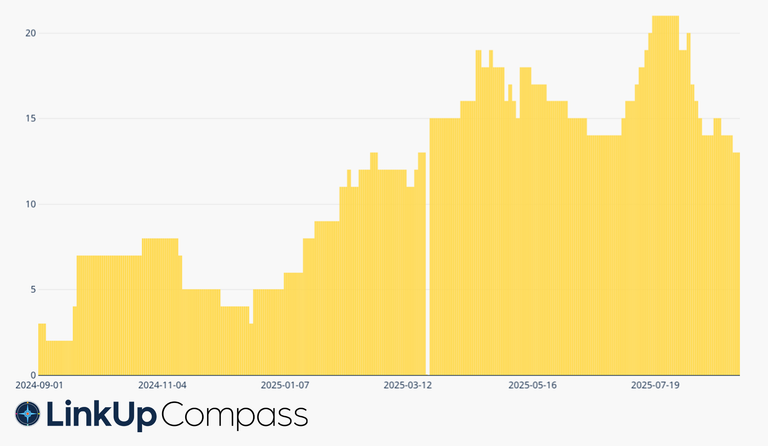

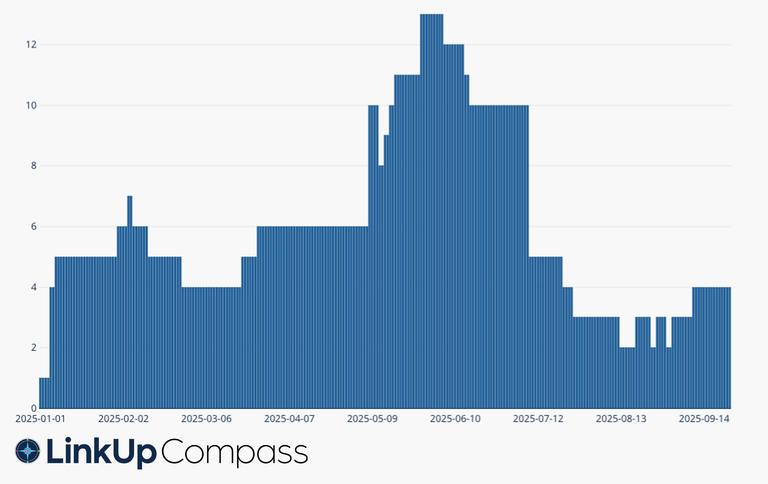

Sales-Related Job Openings at Anthropic YoY

Sales Related Job Openings at OpenAi from top of 2025

Liberation Day Hangover: Trump Bump Meets Tariff Reality

Trump's January 20th inauguration spurred significant hiring rallies at major manufacturers and retailers, followed by sharp declines after the April 2nd tariff announcement. LinkUp data captures both phases of this pattern clearly—a steady hiring increase beginning in late January with Trump’s ascendency, followed by an equal and opposite decline beginning shortly after “Liberation Day” on April 2.

The employment data aligns with trade analysis: rather than bringing manufacturing back to the U.S., 61% of supply chain executives expect companies to relocate to lower-tariff countries, with nearly half saying reshoring would more than double costs CNBCDavron.

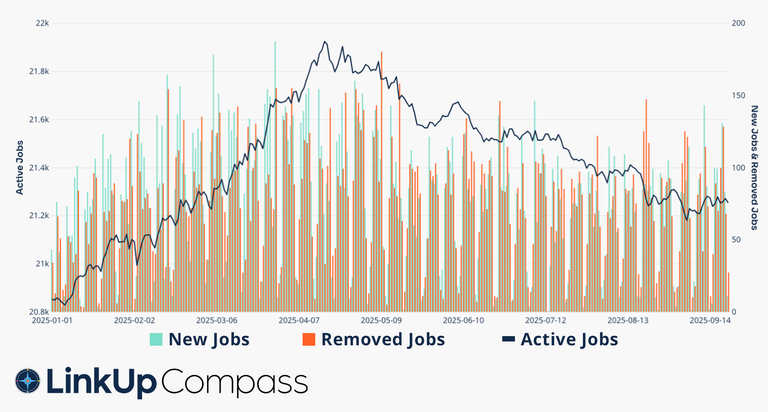

Daily Active Listings at Lowe’s since 1/1/2025

Active listings at Lowe’s increased from around 3,500 in January to over 8,000 by early April—a 129% increase. Following the tariff announcement, listings made a steady decline to under 4,000 by September.

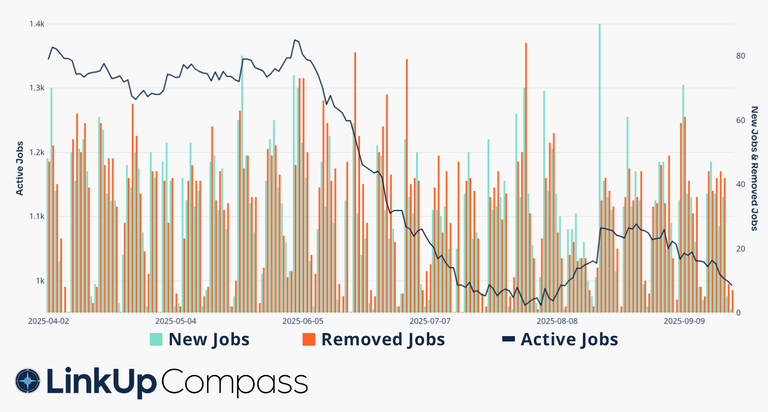

Daily Active Listings at Nike since 4/2/2025

The chart shows a daily listing decline from 1,370 peak to 1,000 by September—a 27% reduction coinciding with the company's tariff concerns.

Daily Active Listings at Home Depot since 1/1/2025

Home Depot active listings climbed through the Trump bump and followed with a slide after tariff announcements.

Daily Active Listings at Caterpillar since 4/2/2025

Caterpillar shows the clearest correlation between tariff policy and hiring decisions. LinkUp data shows listings declining from around 1,700 in April to 1,100 by September—a 35% drop that preceded the company's announcement that Trump's tariffs would reduce its operating income by $1.5 billion in 2025 Trump's tariffs are strangling economic productivity.

Oracle's Strategic Workforce Restructuring for Cloud Transition

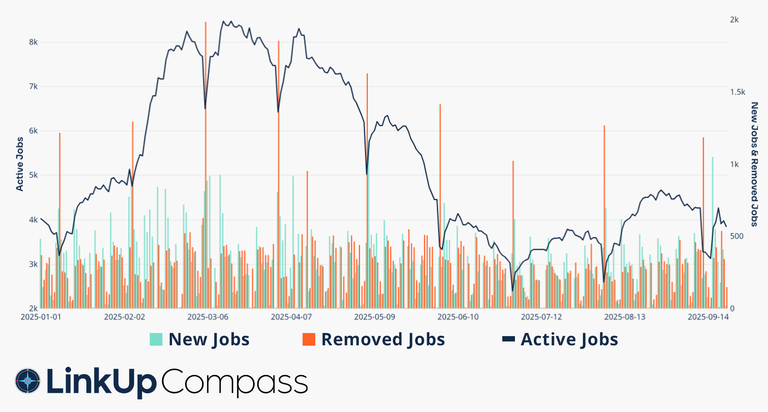

Daily active listings at Oracle fell by over 3,000 postings between January and September, as the company reallocates resources from traditional ERP services toward AI infrastructure development.

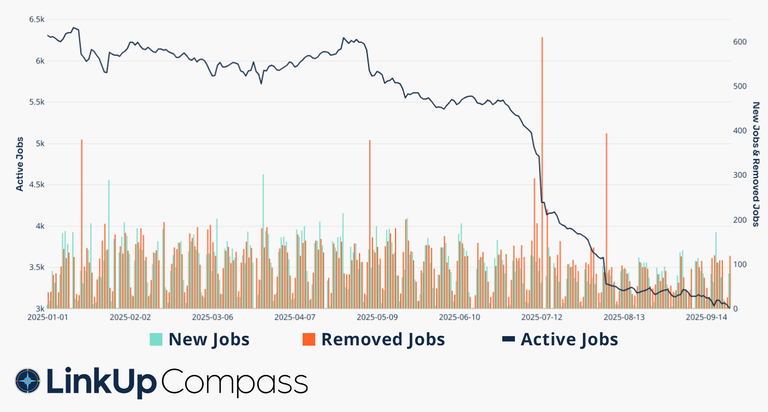

Daily Active Listings at Oracle since 1/1/2025

Our Oracle Jobs chart shows the timeline: active listings declined from around 6,200 in January to approximately 3,100 by September—a 50% reduction concentrated in July and August, with over 600 positions removed in single days before official announcements.

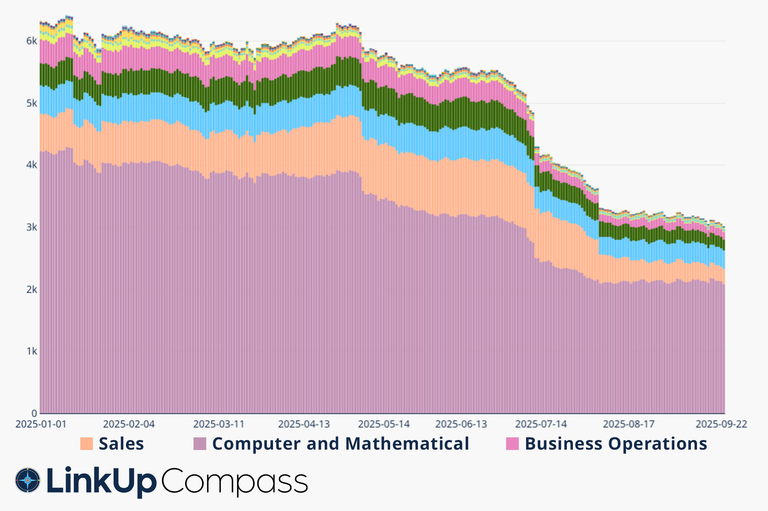

Daily Active Listings at Oracle by Occupation since 1/1/2025

The Oracle Occupation Detail chart above reveals the strategic focus: while total headcount declined from around 6,000 to under 3,000 positions, cuts were selective. Sales-related roles (peach) and business ops positions (pink) saw heavy reductions, while Computer and Mathematical roles (lavender) declined proportionally less. This pattern supports Oracle's pivot from legacy ERP sales toward AI-focused technical development.

The strategic context supports the workforce changes: Oracle is participating in the $500 billion Stargate AI infrastructure project with OpenAI and SoftBank, requiring $40 billion in NVIDIA-powered infrastructure investment. Oracle's stock has increased 36% since announcing its AI pivot, adding $244 billion to market capitalization, and indicating investor approval of the workforce restructuring as necessary transformation.

Layoff Signal: Novo's Month-long Signal Trail

The Compass chart below demonstrates how employment data often precedes public disclosure: Novo Nordisk's September 10th announcement of 9,000 layoffs was signalled in LinkUp data a month earlier.

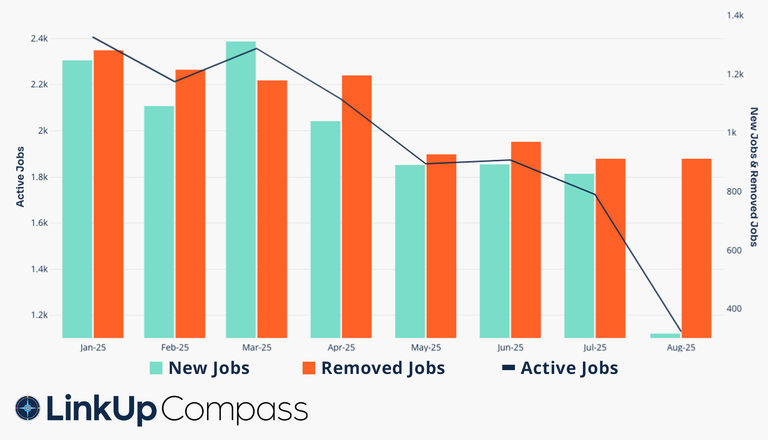

Monthly Active Listings at Novo Nordisk since 1/1/2025

The chart shows monthly listings at the Danish pharma fell from ~2,500 in March to under 1,000 by August—a 60% reduction made obvious by scant new listings in August. This type of sudden hiring freeze paired with rapid listing removal often indicates imminent workforce reductions.

The restructuring affects 5,000 jobs in Denmark alone and aims to save $1.3 billion annually by 2026 as new CEO Mike Doustdar responds to competitive pressure. The cuts reflect increasing competition from Eli Lilly's weight-loss drug Zepbound and cheaper compounding pharmacies in the U.S. obesity market.

Our employment data provided over five weeks of advance notice—valuable intelligence for investors monitoring the pharmaceutical sector. Companies typically implement hiring freezes before announcing major layoffs, making job posting removal rates reliable leading indicators.

For more insights into employment trends that predict business outcomes, explore LinkUp Compass Playground. Real companies, real job openings, real forward-looking intelligence.

More like this: Related insights and resources

-

Blog

02.04.2026

LinkUp Forecasting That the U.S. Economy Lost 25,000 Jobs in January

Read full article -

Blog

01.19.2026

The U.S. Economy, as a Job Creating Machine, Has Been Shut Off & Will Soon Be Hemorrhaging Jobs

Read full article -

Blog

01.16.2026

December 2025 Jobs Recap: U.S. Labor Demand Continued to Contract

Read full article

Subscribe to our newsletter: Get monthly U.S. labor market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.