LinkUp Forecasting a Net Gain of 195,000 Jobs In January

Despite the chaos and din we expect as the backdrop for the year, January’s jobs numbers should provide a preview of what we also expect in 2024 - a resilient job market powering a strong economy.

Driven in large part by our forecast for a much stronger job market than consensus estimates, as we wrote earlier this week with our 10 predictions for the year ahead, we’re expecting to see a stronger U.S. economy than what most people are expecting this year, even after most have finally, at long last, started to acknowledge the reality of the soft landing and adjusted their 2024 forecasts accordingly.

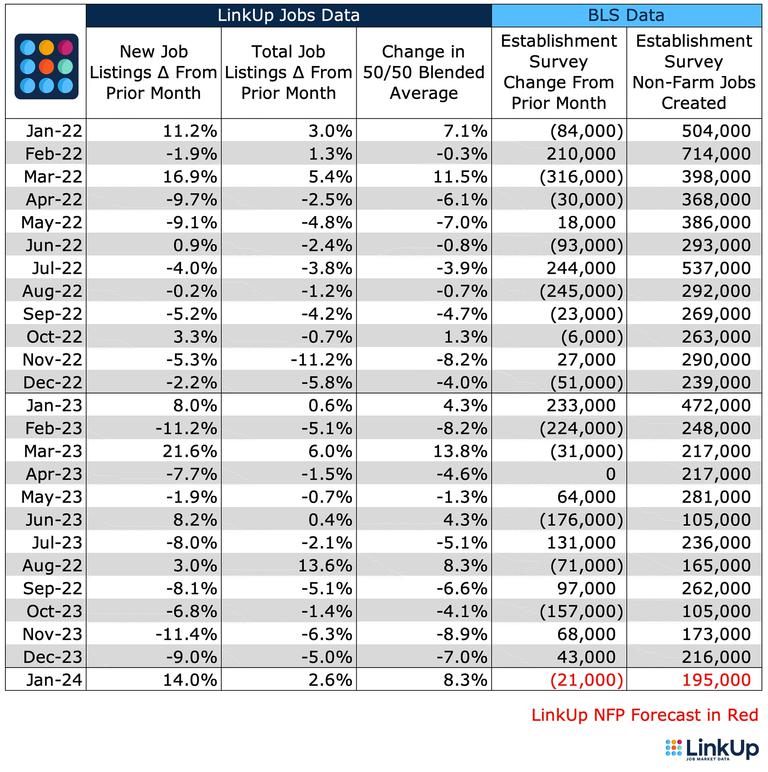

With tomorrow’s jobs report for January, we certainly won’t have to wait long for the first test of our outlook. Based on our data for the past few months along with our NFP forecasting model and the unique job market anomalies that typically occur in January, we are forecasting a net gain of 195,000 jobs in January.

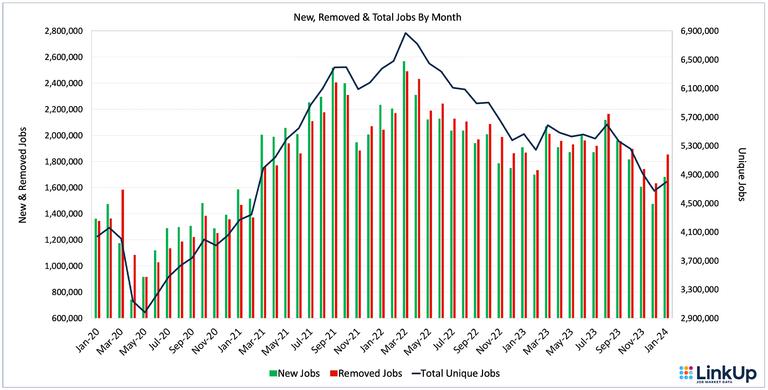

Looking at our job market data for January, sourced entirely from millions and millions of job openings that we index every day directly from employer websites around the world, total U.S. jobs indexed directly from company websites rose 3% in January while both new and removed jobs jumped 14%.

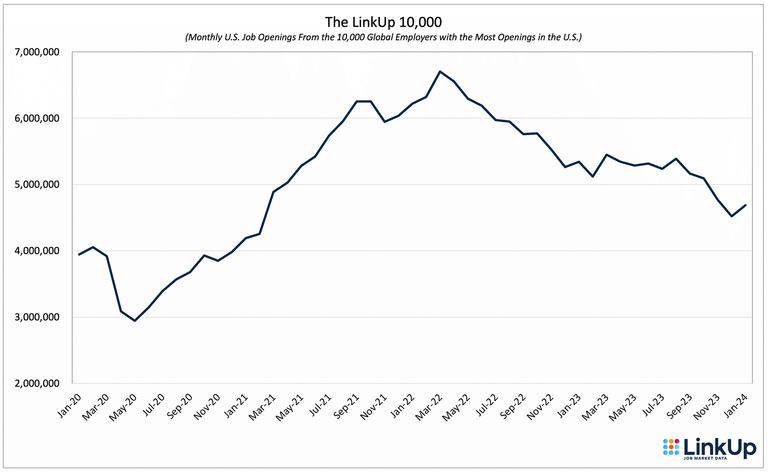

Similarly, the LinkUp 10,000 - a metric that tracks the total U.S. job openings from the 10,000 global employers with the most openings in the U.S., rose 4% in January.

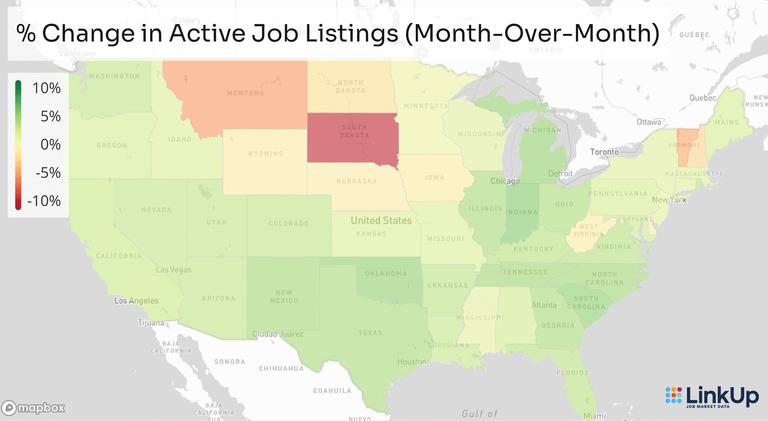

Job openings increased in 38 states in the U.S. with the largest increase in Indiana (5%) and the largest decline in South Dakota (-9%).

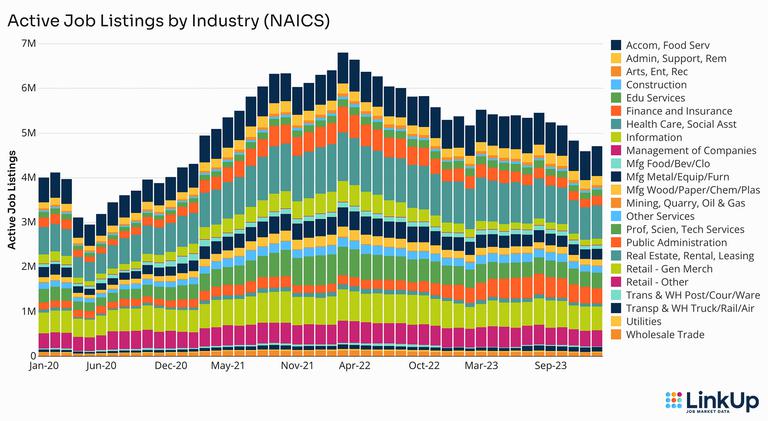

Equally as encouraging, labor demand rose in nearly every industry with the largest increases in Utilities (10%), Real Estate (9%), and Finance (7%).

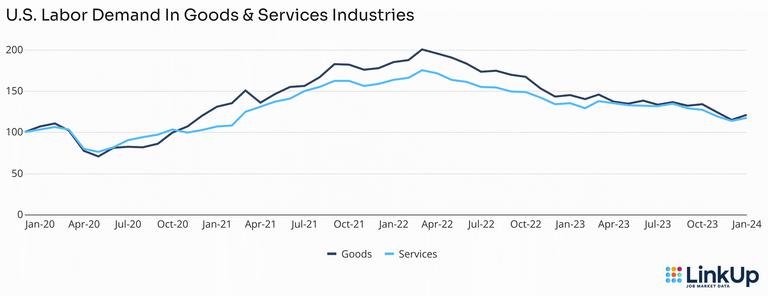

Labor demand in manufacturing rose just a hair faster than in services.

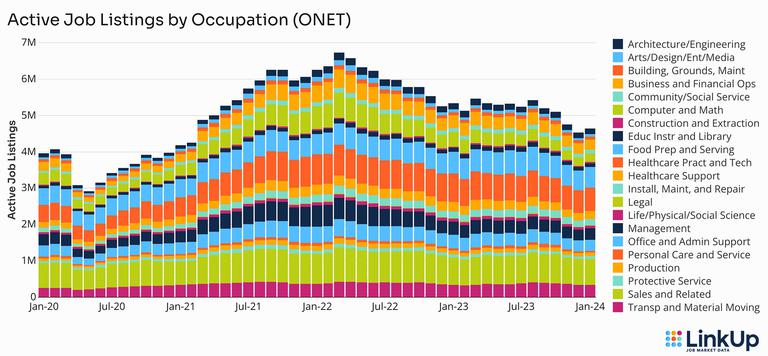

Looking at specific occupations, openings rose in all but two with the largest gains in Construction (7%), Healthcare Support (7%), and Personal Care & Services (6%).

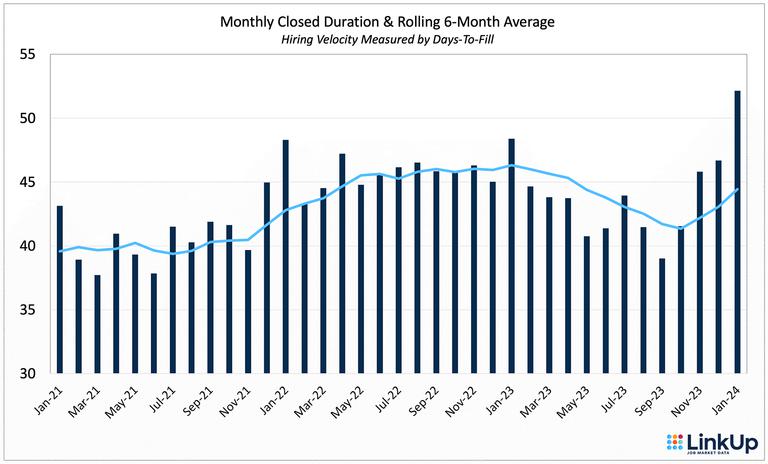

Hiring velocity slowed in January as the average time-to-fill (as measured by our Closed Duration metric) rose from 47 to 52 days. Closed Duration measures the number of days an opening, on average, is open on a company’s corporate career portal before it is removed.

But as we note every January, employers typically do some spring cleaning on their corporate career portals in January to align job openings with newly updated hiring plans for the coming year. This results in a pretty severe spike in both new and removed jobs.

In fact, over the past 11 years, new jobs added to company websites in January have risen an average of 22% from December (12 times the average monthly rise of 1.8% for all months of the year) and jobs removed have risen an average of 10% from December (almost 6 times the average monthly rise of 1.8% for all months of the year). It’s that spike in removed jobs in January that translates into somewhat of an inflated jump in Closed Duration in January every year.

But regardless of the seasonal Closed Duration anomaly, our job market data for January should set things up for a solid start to 2024. As mentioned previously, we’re forecasting a net gain of 195,000 jobs in January, slightly above the consensus estimate of 180,000 jobs. Given the jump in new openings this past month, we’d also expect, at least preliminarily, to see further job gains in February.

So despite the chaos and din we expect as the backdrop for the year, January’s jobs numbers should provide a preview of what we also expect to see - a resilient job market that will continue to power a very steady economy.

Insights: Related insights and resources

-

Blog

12.13.2023

LinkUp's November 2023 JOLTS Forecast

Read full article -

Blog

12.07.2023

What’s in a Job Listing? The LinkUp Difference

Read full article -

Blog

12.07.2023

November 2023 Jobs Recap: Job Growth Falls from Plateau to Decline

Read full article -

Blog

12.01.2023

$7 Mayonnaise Might End Democracy

Read full article -

Blog

11.24.2023

Black Friday 2023: Retail hiring down 10% signals caution

Read full article -

Blog

11.21.2023

Job Board Data Pollution: Expired Listings Slow Data Down (Part 3)

Read full article -

Blog

11.17.2023

Job Board Data Pollution: How Duplication Bloats the Labor Market (Part 2)

Read full article -

Blog

11.15.2023

Job Board Data Pollution: The Nefarious Underworld of Fake Jobs (Part 1)

Read full article -

Blog

11.09.2023

Job Board Data Pollution: An Introduction

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.