Larger Tectonic Forces Shaping Job Market Dynamics Will Soon Return to Center-Stage

As we wrote in our October non-farm payrolls forecast on November 2nd just prior to the October jobs report, we wanted to hold off on our commentary on the job market until after the deluge of events over the past few weeks. And given the October jobs numbers, the most recent inflation report, the Fed meeting minutes released last week, and a handful of other miscellaneous headlines, not to mention the mid-terms, that seems to have been the right call.

Needless to say, there’s a lot to cover, not only regarding the obvious observations about the job market (still strong but with declining demand) and inflation (finally ebbing), but also, and perhaps more importantly, about what we expect to be the major themes around employment for the coming year as well as the longer-term trends that will impact labor supply-demand imbalances and, therefore, wages, for years to come.

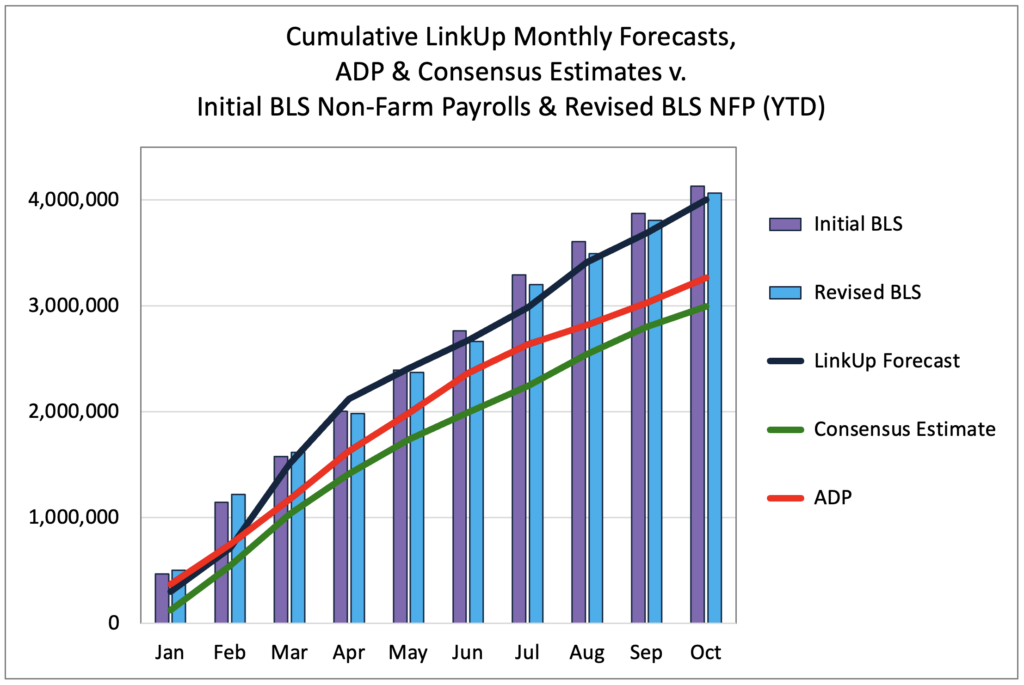

So beginning with October’s payrolls, we we were not at all surprised by the strong report that came in well above what most people expected. Just as we indicated in our post on the 2nd, the initial report (261,000 jobs) came in above consensus estimates (195,000 jobs) and there’s a decent chance that subsequent revisions in the next two BLS reports will raise that number even closer to our forecast (315,000).

With October’s numbers, our forecast track record for the year improved even further as our negligible tracking error dropped from 2% to 1.6%.

Despite solid job gains for the month (and it’s important to remember that October is almost always a strong month of hiring and typically comes in above consensus), labor demand continues to fall.

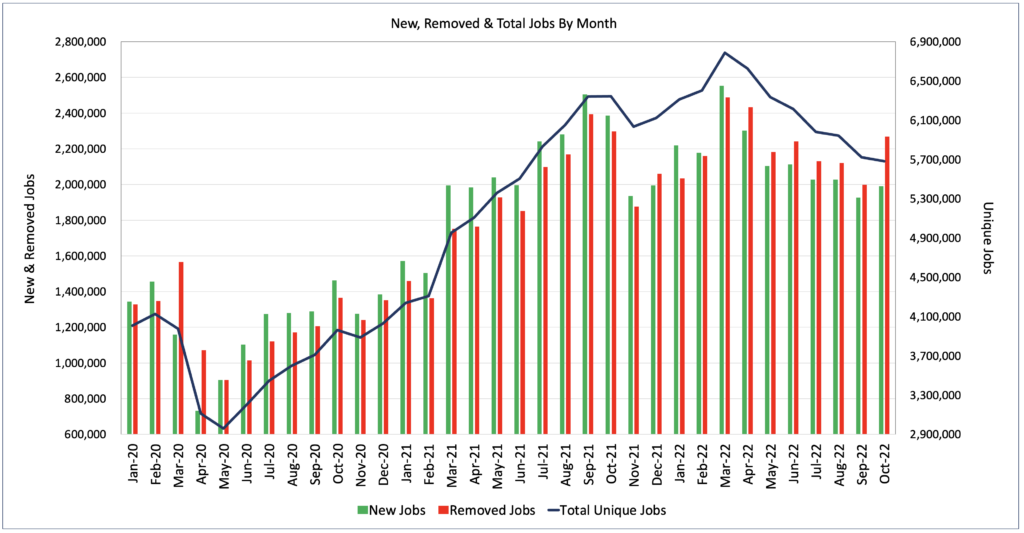

In October, job openings in the U.S. indexed directly from corporate websites globally dropped 0.7%.

Far more noteworthy, however, is that the fact that of the 270,000 jobs removed from employer websites (another indication and predictor of strong hiring during the month), employers only posted 65,000 new openings. Since peaking in March, labor demand has dropped 16% through October, and that trend has continued in November as the LinkUp 10,000 has averaged 3.52 million job openings per day through the 28th as compared to an average of 3.57 million per day in October.

The LinkUp 10,000 measures the total number of U.S. job openings from the 10,000 global employers with the most openings in the U.S. We publish that metric daily and monthly on our website.

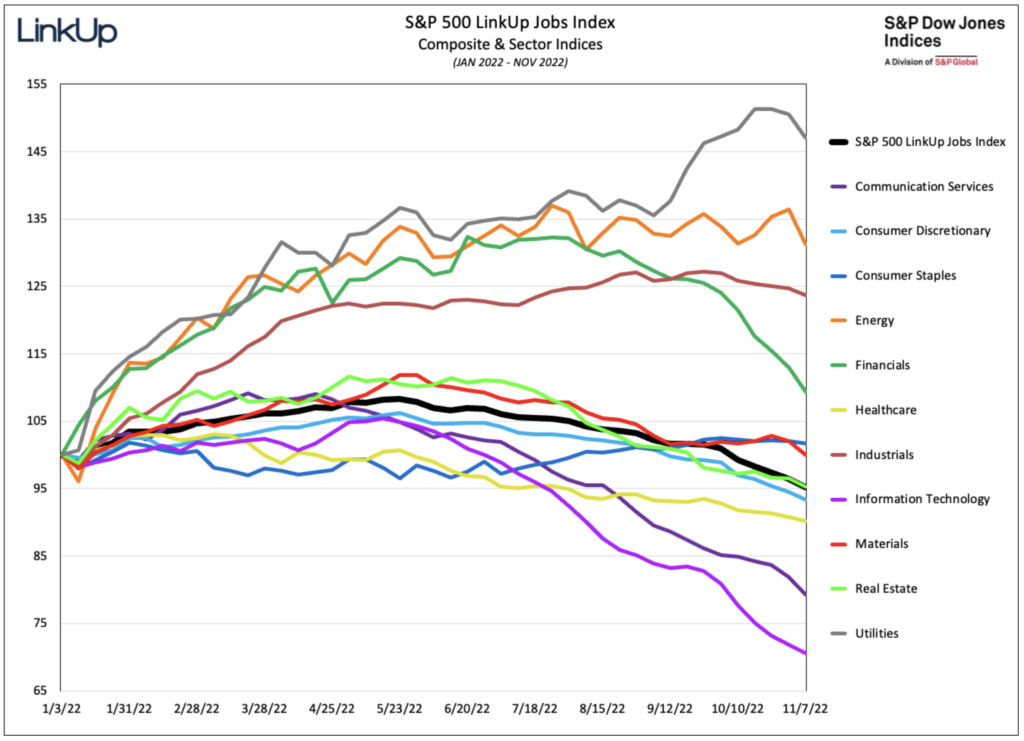

The S&P 500 LinkUp Jobs Index dropped 5% in October and has continued its steady decline in November. Since peaking in May, labor demand among S&P 500 companies has dropped 12% and only Energy, Materials, and Utilities have escaped the decline. Conversely, Information Technology and Communication Services are down 33% and 24% respectively.

So clearly, labor demand is (and has been for some time) dropping like a rock. More significant, however, is the fact that with 4 consecutive rate hikes of 75bps, combined with a host of secondary contributing factors, most notable being supply chain issues subsiding, core inflation has finally started ticking down.

To be sure, a single monthly data point is hardly worth getting overly excited about and recent data (housing, consumer confidence, durable goods orders) point to an economy that just keeps chugging along. And most importantly (of course), monthly job gains continue to defy expectations of most observers.

Despite the huge drop in job openings and the growing number of layoff announcements (which are coming mostly from tech companies and are quite trivial in the aggregate), companies are still hiring aggressively and wages are still inching up. In the Fed’s war on inflation, it is wages that are proving to be the stickiest, least volatile, and most critical component of inflation. As Krugman noted in a recent op-ed piece, “For the most part, I’ve given up on trying to find the “right” price index. Instead, these days I mostly look at wages as an indicator of underlying inflation.”

And as we noted in a post on September 25th, because wage inflation is simply a function of supply-demand imbalance, we’re back full circle back to what we have been saying for quite some time – it’s all about job openings – the rest is noise.

So as we approach the end of 2022 and start thinking about what’s in store for the year ahead, what can we expect as far as supply/demand imbalance and wage inflation?

In the short-term, we expect that monthly job gains are going to slowly ratchet down and the job market will continue moving towards increased equilibrium between supply and demand. While monthly numbers are likely to remain volatile, we remain confident that over the next 3-6 months or so, greater equilibrium will be achieved through movement on both sides of the hiring equation – employers, on the demand side, filling vacancies (and continuing to raise wages if and where necessary) and reducing, in the aggregate, the number of openings and job seekers, on the supply side, continuing to return to the labor market as wages continue inching up and employers continue making necessary concessions to bring people back to the workforce.

This is, of course, the oft-mention soft-landing and we have been of the view all year that not only is a soft-landing possible, it’s been the highest probability scenario all along. The wild-card has always been (and very much remains) the Fed’s patience to let its rate hikes take effect – but as the minutes from the most recent Fed meeting show, patience seems to be gaining momentum. We’ll see how things unfold in the months ahead and, of course, we’ll keep nowcasting our labor demand data and forecasting non-farm payrolls every month along with some commentary on the shorter-term outlook for the job market.

But as the dust settles from the Covid earthquake that rocked the world (assuming that after-shocks don’t persist) and the job market ‘normalizes’ towards greater equilibrium, we’ll be turning the broader focus of our monthly commentary in the coming months to the deeper, more fundamental tectonic forces that have always shaped the supply-demand dynamics of job market. These seismic forces have been largely obscured by the pandemic, but they never went away and to a large extent, they have been accelerating for the past few years.

These forces include:

- Demographics & an aging workforce

- Automation, AI & Robotics

- Climate change

- Globalization

- Immigration

- Balance of power between capital and labor

- Job market liquidity

- And because the pandemic has permanently altered the job market landscape, we’ll add to the list above a few new forces impacting the job market:

- The Great Resignation

- Remote work

The books, papers, and articles on each the above would fill a large library, but from a thematic standpoint, these will constitute the overlay of our monthly commentary for the foreseeable future and we’ll do our best to adequately summarize the issues, lend insights to them through our job data, and weigh in on how they are impacting the supply-demand dynamics of the job market.

Ultimately, it is our view that going forward, wage inflation will decline from its presently elevated level but will persist at a rate above its historical average over the past few decades and that the Fed will need to adjust its long-term, 2% inflation target accordingly.

As we wrote last September, “inflation in the short-term will be abnormally high but will subside to a large degree once Covid gets under control, supply bottlenecks gets addressed, and the world returns to some sort of new normal. But we also believe that that new normal will include an average rate of inflation above what we’ve been used to for a long time. And beyond that is anyone’s guess as the job market over the long-term is impacted by major tectonic forces including, among others, demographics, public policy, technology, immigration, globalization, and the long-term impact of the pandemic, to name just a handful.”

While we may have been a bit aggressive in how we defined ‘short-term’ (although I’d argue that 14 months in the context of a geological analogy is short-term), there is no doubt whatsoever that the larger ‘tectonic forces’ are going to come roaring back to the spotlight, center stage, in the coming months.

In the meantime, look for our forecast for Friday’s jobs report for November on Thursday morning once we have our full data for the entire month of November.

Insights: Related insights and resources

-

Blog

09.01.2022

Strong Job Gains in August Will Keep the Fed-Inflation Debate Cauldron Raging

Read full article -

Blog

12.05.2019

Labor Market "Canary In the Coal Mine" May Have Died In November; LinkUp Forecasting Weak Job Growth of Just 80,000 Jobs

Read full article -

Blog

01.03.2019

The Wage Inflation Narrative Is About To Be Upstaged By A Nasty Jobs Report

Read full article -

Blog

10.29.2018

Accelerating Hiring Velocity Means We Cannot Publish Our October NFP Forecast Until 10AM On Thursday, November 1st

Read full article -

Blog

03.26.2018

LinkUp Forecasting Net Gain of 235,000 Jobs In March; Wage Inflation Will Accelerate in Months Ahead

Read full article -

Blog

11.03.2015

The Glass Is Half Empty; October NFP To Disappoint (Again)

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.